🧾 Tax & Tip Calculator

Table of Contents

Let’s say you’re at a restaurant with friends after a fun day out. The bill arrives, and suddenly everyone starts fumbling with calculators or napkins, trying to figure out how much tax to add, how much tip to leave, and how to split the total fairly. Sound familiar? This is a common scenario for many people, and it’s exactly why a tax and tip calculator exists—to simplify what can feel like a confusing math problem.

The Problem with Manual Calculations

When you’re dining out, shopping, or splitting costs with others, manually calculating tax and tip can lead to mistakes. For example:

- Tax rates vary by location : In California, the average sales tax is 9.5%, but it can be higher in cities like San Francisco (9.75%) or lower in others. Trying to remember these rates while splitting a bill is overwhelming.

- Tips depend on service and customs : Some people leave 15%, others 20%, and some prefer to tip only on the pre-tax amount. Without a clear tool, it’s easy to overpay or underpay.

- Splitting bills fairly : If a group of four friends splits a $100 bill with 10% tax and 18% tip, who actually owes what? Manual division often leads to confusion.

This is where a tip and tax calculator becomes essential. It’s not just for restaurants—it’s a universal tool for anyone who wants to handle expenses accurately and quickly.

What Makes Our Calculator Unique?

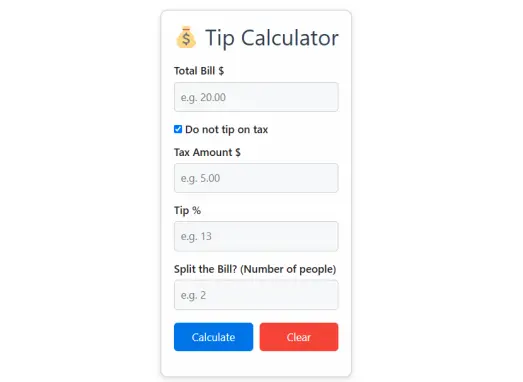

Our universal tax and tip calculator is designed to solve all these issues with a few simple steps. Here’s how it works:

- Total Bill Input : Enter the base amount (e.g., $50 for a meal).

- Tax Customization : Adjust for your state’s tax rate. If you’re in California, the calculator automatically applies the correct rate, but you can also input a custom tax amount.

- Tip Flexibility : Choose any percentage (e.g., 13%) or use presets like 15% or 20%.

- Split the Bill : Enter the number of people sharing the cost. The calculator divides the total (including tax and tip) evenly.

- “Do Not Tip on Tax” Option : Some regions prefer tipping only on the pre-tax amount. Toggle this feature to match local customs.

For example, if you’re in California and order a $60 meal with 9.5% tax, the calculator will add $5.70 in tax. If you decide to tip 18% on the pre-tax amount ($60), the tip becomes $10.80. Splitting this between two people means each pays $38.25. No more guessing!

Why This Matters for Everyday Life

A sales tax and tip calculator isn’t just for restaurants. It’s useful for:

- Events : Splitting costs for a group dinner or bar tab.

- Retail : Adding tax to a purchase and calculating a tip for delivery or service.

- Travel : Handling expenses in different states with varying tax rates.

Even better, our tool handles discounts . If you have a $10 coupon for a $50 meal, the calculator subtracts the discount before adding tax and tip, ensuring you pay the correct amount.

Your Go-To Solution

Whether you’re in California or another state, our discount tax and tip calculator eliminates the stress of manual math. It’s a free, instant solution for anyone who wants to:

- Avoid overpaying due to miscalculations.

- Respect local tipping customs (like pre-tax vs. post-tax tips).

Split costs fairly with friends, family, or colleagues.

Key Features of Our Calculator

Now that we’ve covered why a tax and tip calculator is essential, let’s explore what makes ours stand out. This tool isn’t just a basic calculator—it’s packed with features designed to simplify even the trickiest expense calculations. Whether you’re splitting a bill in California or adjusting for a discount at a local café, our calculator handles it all. Let’s break down each feature step by step.

1. Tax and Tip Calculator: Your One-Stop Solution

The core of this tool is its ability to calculate sales tax and tip instantly. Imagine ordering a $45 meal in a state with 8% tax and wanting to leave a 15% tip. Without a calculator, you’d need to do three separate calculations:

- Tax : 8% of $45 = $3.60

- Tip : 15% of $45 = $6.75

- Total : $45 + $3.60 + $6.75 = $55.35

Our tip and tax calculator does all this in seconds. Just enter the base amount ($45), select your state (or input the tax rate manually), and choose your tip percentage. The tool will show you the total with tax and tip, plus the per-person cost if you split the bill. This is especially helpful in places like California, where tax rates vary by city.

2. Split Bill Calculator with Tax and Tip: Fairness Made Easy

Splitting a bill among friends or family doesn’t have to be a guessing game. Our split bill calculator with tax and tip ensures everyone pays their fair share.

For example, say four friends order a $120 meal with 9% tax ($10.80) and decide to leave a 20% tip ($24). The total becomes $154.80. If they split the bill evenly, each person pays $38.70. The calculator handles this automatically by:

- Calculating the total (including tax and tip).

- Dividing it by the number of people.

This feature is perfect for group dinners, office lunches, or even splitting a hotel bill. No more awkward debates over who owes what!

3. “Do Not Tip on Tax” Option: Follow Local Customs

In some regions, it’s customary to tip only on the pre-tax amount of a bill. For example, if your meal costs $30 and tax is $3 (10%), you might tip 15% on $30 instead of $33. Our calculator includes a toggle for this—just check the box labeled “Do Not Tip on Tax” .

Here’s how it works:

- With the box unchecked : Tip is calculated on the total bill + tax.

- With the box checked : Tip is calculated only on the pre-tax amount.

This is particularly useful in areas like California, where tipping customs can vary between restaurants. It also helps avoid overpaying if you’re unsure whether to include tax in your tip.

4. Custom Tax Input: Adjust for Any Location

While many states have standard tax rates, local municipalities often add extra charges. For instance, San Francisco has a 9.75% tax rate, while Los Angeles uses 9.5%.

Our sales tax and tip calculator lets you input the exact tax amount manually. If you’re dining in a city with a unique tax rate, just enter the amount (e.g., $4.75 for a $50 meal in California). The tool will adjust the tip and total accordingly. This ensures accuracy, no matter where you are.

Why These Features Matter

Each of these features addresses a real-world problem:

- Accuracy : Avoid errors in tax, tip, or split calculations.

- Customization : Adapt to local tax rates, tipping customs, and discounts.

- Simplicity : Get results instantly without manual math.

Whether you’re in California or another state, our calculator is designed to handle your specific needs.

How to Use the Tax and Tip Calculator

Now that you’re familiar with the key features of our tax and tip calculator , let’s walk through how to use it step by step. This tool is designed to be intuitive, but understanding each part will help you get the most accurate results. Whether you’re in California or another state, the process is the same—just follow these simple instructions.

Step 1: Enter the Total Bill Amount

The first step is to input the total amount before tax and tip . This is the base cost of your purchase, meal, or service. For example:

- If you ordered a 40meal,type∗∗40.00∗∗intothe“TotalBill ” field.

- If you’re shopping online and the item costs $25, enter 25.00 .

This number becomes the foundation for all calculations. Make sure to include cents (e.g., $20.50 for a $20.50 bill) to avoid rounding errors later.

Step 2: Decide Whether to Tip on Tax

Next, you’ll see a checkbox labeled “Do Not Tip on Tax” . This is a critical choice because it affects how the tip is calculated.

- If unchecked : The tip is calculated on the total bill including tax . This is common in many regions.

- Example: A $50 meal with $5 tax. Tip is calculated on $55.

- If checked : The tip is calculated only on the pre-tax amount . This aligns with local customs in some areas.

- Example: A $50 meal with $5 tax. Tip is calculated on $50.

If you’re unsure, leave the box unchecked unless you know the service expects pre-tax tipping (e.g., some restaurants in California).

Step 3: Add the Tax Amount

If you already know the tax amount, enter it directly into the “Tax Amount $” field. For example:

- A $50 meal in California with 9.5% tax: $50 × 0.095 = $4.75 .

If you’re unsure of the tax rate, skip to the next step and let the calculator handle it automatically based on your state selection (explained later).

Step 4: Choose Your Tip Percentage

The “Tip %” field lets you set the gratuity percentage. You can:

- Enter a custom value (e.g., 13% for a small group).

- Use presets like 10%, 15%, or 20%.

For example:

- A $50 meal with 15% tip = $7.50 .

- A $25 purchase with 10% tip = $2.50 .

This step is flexible, so adjust the percentage based on the service quality or local expectations.

Step 5: Split the Bill (Optional)

If you’re sharing the cost with others, use the “Split the Bill? (Number of people)” field. Just enter how many people are splitting the total.

For example:

- A $60 meal with 9% tax ($5.40) and 18% tip ($10.80) = Total of $76.20.

- If split between 3 people: $25.40 per person .

This feature ensures everyone pays fairly, especially for group dinners or office events.

Step 6: Click “Calculate”

Once you’ve filled in all the fields, click the “Calculate” button. The tool will instantly show:

- Total Bill : The base amount you entered.

- Tax Amount : The tax added (if applicable).

- Tip Amount : The gratuity calculated based on your percentage.

- Total with Tax & Tip : The final amount you’ll pay.

- Per-Person Cost (if you split the bill).

For example:

- Total Bill : $50

- Tax : $4.75

- Tip (15%) : $7.50

- Total : $62.25

- Split Between 2 People : $31.13 each

This breakdown makes it easy to understand where your money is going.

Step 7: Clear and Recalculate

If you want to try different numbers, click the “Clear” button to reset the form. This is handy for testing scenarios like:

- “What if I leave a 20% tip instead?”

- “How much would a $5 discount save me?”

The calculator is yours to experiment with until you find the perfect setup.

Why This Process Works for Everyone

This step-by-step approach is designed to handle any situation :

- Restaurants : Calculate tips and splits for meals.

- Retail : Add tax to purchases and apply discounts.

- Travel : Adjust for different state tax rates (e.g., California vs. Texas).

By breaking down the process, the restaurant calculator tax and tip ensures accuracy and transparency.

Also read: Tattoo Tip Calculator & Tipping Guide

Example Calculation (California): A Real-Life Scenario

Let’s walk through how our tax and tip calculator works using a real-world example. You’re dining at a well-known restaurant in San Francisco, California, with three friends. The pre-tax bill is $75, and you plan to leave a 15% tip. Here’s how the math plays out step by step.

Step-by-Step Breakdown

This table shows the main inputs you’ll enter into the calculator. It also shows how tax, tip, and split amounts are calculated if you tip only on the pre-tax bill (a common practice in California).

| Step | Input / Action | Value |

|---|---|---|

| 1. Total Bill (pre-tax) | Enter meal cost | $75.00 |

| 2. Tax Rate | San Francisco (9.75%) | $7.31 |

| 3. Tip Percentage | Enter 15% (on pre-tax amount) | $11.25 |

| 4. Total w/ Tax & Tip | $75 + $7.31 + $11.25 | $93.56 |

| 5. Split Between (4 people) | Enter number of diners | 4 |

| 6. Cost Per Person | $93.56 ÷ 4 | $23.39 |

What If You Tip on Tax Too?

Some diners prefer to tip on the full bill, including tax. This table shows how the numbers change if you leave the “Do Not Tip on Tax” box unchecked. The final amount increases slightly due to the higher tip base.

| Scenario | Tip on Full Amount (incl. tax) |

|---|---|

| Total After Tax: | $75 + $7.31 = $82.31 |

| Tip (15% of $82.31): | $12.35 |

| Final Total: | $94.66 |

| Per Person (÷ 4): | $23.67 |

| 💡 Difference: | You pay $1.10 more overall |

Key Takeaways for California Diners

Here’s why this calculator is especially useful in California. The sales tax rate varies by city, tipping norms differ by restaurant, and group dining is common. Using this calculator helps you handle all these factors with ease.

| Why It Matters | Details |

|---|---|

| Tax Rates | SF: 9.75%, LA: 9.5%, others vary |

| Tipping Norms | Often on pre-tax only |

| Split Bill Feature | Makes group payments fair and fast |

| Real-Time Adjustments | Test different tip %, tax, or group size instantly |

What If You Leave the “Do Not Tip on Tax” Box Unchecked?

If you uncheck the box, the tip is calculated on the total bill including tax . Here’s how the math changes:

- Total Bill + Tax : $75 + $7.31 = $82.31

- Tip (15%) : 15% of $82.31 = $12.35

- Total with Tax & Tip : $82.31 + $12.35 = $94.66

- Per-Person Cost : $94.66 ÷ 4 = $23.67

This shows how the “Do Not Tip on Tax” option can affect the final amount—by $1.10 in this case.

Practical Takeaways

- Use the calculator for accuracy : Manual calculations can lead to errors, especially with varying tax rates and tipping customs.

- Test different scenarios : Try leaving the “Do Not Tip on Tax” box unchecked or adjusting the tip percentage to see how it impacts the total.

- Plan ahead for group meals : The split bill feature ensures fairness, even for larger groups.

Why California Is a Common Use Case

California’s tax and tipping landscape is complex:

- Tax Rates : Vary by city (e.g., 9.25% in Los Angeles, 9.75% in San Francisco).

- Tipping Norms : While 15–20% is standard, some restaurants expect pre-tax tips.

- Group Dining : Many Californians split meals with friends or family, making the split bill calculator essential.

By using the restaurant calculator tax and tip , you eliminate the guesswork and ensure you’re paying the right amount—no matter where you are in the state.

Understanding the “Do Not Tip on Tax” Option

Let’s dive deeper into one of the most unique and practical features of our tax and tip calculator : the “Do Not Tip on Tax” option. This setting might seem small, but it plays a big role in how your total is calculated, especially in places like California where tax rates vary and tipping customs can differ between restaurants. Let’s break it down step by step.

What Does “Do Not Tip on Tax” Mean?

When you check this box, it tells the calculator to exclude tax from the tip calculation . This means your tip is based only on the pre-tax amount of the bill.

- Example 1 (Box Checked):

- Meal Cost : $50

- Tax : $4.75 (9.5% in California)

- Tip (15%) : 15% of $50 = $7.50

- Total : $50 + $4.75 + $7.50 = $62.25

- Example 2 (Box Unchecked):

- Meal Cost : $50

- Tax : $4.75

- Tip (15%) : 15% of $54.75 ($50 + $4.75) = $8.21

- Total : $50 + $4.75 + $8.21 = $62.96

The difference of $0.71 might seem small, but it adds up for larger bills or group splits.

Why This Matters in California and Beyond

In many U.S. states, including California, it’s common for diners to tip only on the pre-tax amount . Some restaurants even expect this, while others may include tax in the tip calculation. This feature ensures you follow the correct practice for your situation.

- California Example :

- If you’re in Los Angeles and order a $60 meal with 9.5% tax, checking the box ensures your 15% tip is based on $60 , not $65.70 .

- This aligns with many local expectations and avoids overpaying.

- Other States :

- In states like New York or Texas, tipping customs may vary slightly, but the “Do Not Tip on Tax” option gives you control regardless of location.

How to Decide Whether to Check the Box

Here’s a quick guide to help you choose:

- Check the Box If :

- You want to tip only on the pre-tax amount (common in many U.S. restaurants).

- You’re in a state or city where this is the standard practice (e.g., California).

- You want to save a few dollars on larger bills.

- Leave the Box Unchecked If :

- The restaurant includes tax in the tip calculation (ask your server if unsure).

- You want to tip on the total amount including tax (a preference in some regions).

- You’re splitting a bill and want to ensure fairness based on the full cost.

Real-World Scenarios

Let’s explore two common situations to see how this feature works:

Scenario 1: Dining Out in California

- Bill : $80

- Tax : 9.5% = $7.60

- Tip (20%) :

- With Box Checked : 20% of $80 = $16.00

- With Box Unchecked : 20% of $87.60 = $17.52

- Total Difference : $1.52

This shows how the choice affects your final payment—especially for higher tips or larger groups.

Scenario 2: Splitting a Bill with Friends

- Total Bill : $100

- Tax : 9% = $9.00

- Tip (15%) :

- With Box Checked : 15% of $100 = $15.00

- With Box Unchecked : 15% of $109.00 = $16.35

- Per Person (Split 4 Ways) :

- With Box Checked : $122.50 ÷ 4 = $30.63

- With Box Unchecked : $125.35 ÷ 4 = $31.34

Even small changes can impact how much each person pays, making this feature essential for fairness.

Tips for Using This Feature

- Ask Your Server : If you’re unsure whether to include tax in your tip, ask the restaurant staff. Many places will let you know their preference.

- Test Both Options : Use the calculator to compare totals with and without the box checked. This helps you decide what’s fair.

- Use for All Purchases : This isn’t just for restaurants. Apply it to retail, services, or any expense where tax and tip are involved.

The “Do Not Tip on Tax” option might seem minor, but it’s a powerful tool for ensuring accuracy and fairness in your calculations. Whether you’re dining in California or splitting a bill with friends, this feature gives you control over how your tip is applied.

You may also like: How Tips Are Calculated – Simple Breakdown

Split Bill Calculator with Tax and Tip: Fair Division Made Easy

Splitting a bill among friends, family, or coworkers doesn’t have to be a headache. Whether you’re sharing a meal at a restaurant, splitting a hotel room, or dividing a group activity cost, our split bill calculator with tax and tip ensures everyone pays their fair share. This feature is especially useful for group outings, office lunches, or even splitting a gift registry. Let’s explore how it works and why it’s essential for fairness and accuracy.

Why Manual Splitting Often Fails

Trying to divide a bill manually can lead to confusion and disagreements. For example:

- Example 1 : A group of four friends orders a $100 meal with 8% tax ($8) and leaves a 20% tip ($24). The total is $132. If they split it evenly, each person pays $33. But if someone ordered more than others, this might feel unfair.

- Example 2 : A $60 dinner in California with 9.5% tax ($5.70) and a 15% tip ($9). The total is $74.70. Splitting it among three people means each pays $24.90—but what if one person had dessert?

This is where the split bill calculator with tax and tip shines. It handles all the math and ensures the division is accurate and equitable.

How the Calculator Handles Group Splits

Here’s how the tool works step by step:

- Enter the Total Bill : Input the base amount before tax and tip (e.g., $80 for a meal).

- Add Tax and Tip : The calculator automatically includes the tax and tip based on your inputs (e.g., 9.5% tax in California and 18% tip).

- Specify the Number of People : Enter how many people are sharing the cost (e.g., 4 friends).

- Get the Per-Person Cost : The tool divides the total amount (including tax and tip) by the number of people.

Example :

- Total Bill : $80

- Tax (9.5%) : $7.60

- Tip (18%) : $14.40

- Total : $102.00

- Split Between 4 People : $102.00 ÷ 4 = $25.50 per person

This ensures everyone pays the same amount, no matter how much they ordered.

Practical situations

Let’s test the calculator in two common situations:

Scenario 1: Group Dinner in California

- Total Bill : $120

- Tax (9.5%) : $11.40

- Tip (20%) : $24.00

- Total : $155.40

- Split Between 6 Friends : $155.40 ÷ 6 = $25.90 per person

Scenario 2: Office Lunch with a Discount

- Total Bill : $90

- Discount : $10 off (e.g., a promo code)

- New Base : $80

- Tax (9%) : $7.20

- Tip (15%) : $12.00

- Total : $99.20

- Split Between 5 Colleagues : $99.20 ÷ 5 = $19.84 per person

In both cases, the calculator handles the discount, tax, and tip before splitting the total, ensuring accuracy.

Why This Feature Matters

The split bill calculator with tax and tip solves real-world problems:

- Fairness : Everyone pays the same amount, regardless of what they ordered.

- Accuracy : It includes tax and tip in the total before dividing, so no one forgets to account for them.

- Simplicity : No more arguing over who owes what—just enter the numbers and let the tool handle the rest.

For example, if a group of three friends splits a $75 meal with 9% tax and 15% tip, the calculator ensures each person pays exactly $30.88 (including tax and tip). This eliminates the need for complex mental math.

Common Questions About Splitting Bills

- Q1 : What if someone ordered more than others?

- A1 : The calculator assumes everyone shares the total equally. If you want to split based on individual orders, you’ll need to calculate separately.

- Q2 : Does the calculator handle pre-tax vs. post-tax tips?

- A2 : Yes! Just check the “Do Not Tip on Tax” box if you want the tip to apply only to the pre-tax amount.

- Q3 : Can I split a bill after applying a discount?

- A3 : Absolutely. Enter the discounted amount first, then add tax and tip. The calculator will split the final total.

Use Cases Beyond Restaurants

While the restaurant calculator tax and tip is ideal for dining out, this feature is also useful for:

- Travel Expenses : Splitting hotel bills, rental cars, or activity costs.

- Retail Purchases : Dividing the cost of a shared gift or group event.

- Service Bills : Splitting a contractor’s invoice or event coordinator’s fee.

For instance, if you and a friend split a $200 hotel stay with 10% tax and a 15% service fee, the calculator ensures each of you pays $126.50.

Frequently Asked Questions (FAQ)

1. How does the calculator handle discounts?

The calculator subtracts any discount before applying tax and tip. This ensures you’re not tipping on the full price and don’t overpay.

2. Why does the “Do Not Tip on Tax” option matter?

Tipping on pre-tax is common in many states. This option helps you calculate tips based only on the base amount, not the taxed total.

3. How accurate is the calculator for different states?

It supports all U.S. states and adjusts for their tax rates. You can enter your state or manually input the tax for more precision.

4. Can I use this calculator for non-restaurant expenses?

Yes, it’s perfect for retail, services, or shared travel costs. Just enter the amount, and the calculator handles tax, tip, and splits.

5. How does the split bill calculator work with varying contributions?

It splits the total equally among all entered people. For different individual orders, you’ll need to calculate manually.

6. What if I want to tip a custom percentage?

You can set any tip amount—10%, 13%, 25%, or more. The calculator adjusts the totals automatically based on your input.

7. How do I know if I’m tipping correctly?

Standard tips: 15–20% for restaurants, 10–15% for delivery, and 20% at bars. You can test different rates in the calculator.

8. Is the calculator free to use?

Yes! It’s 100% free with no sign-up required. You can use it as often as you like.

9. What if I made a mistake in my inputs?

Click the “Clear” button to reset everything and start over. It’s perfect for testing different scenarios or correcting errors.

10. Can I use this tool for international tax and tip calculations?

The calculator is designed for U.S. rates. For international use, you can enter the local tax manually if you know the percentage.

Closing Notes

In a world where tax rates vary by city, tipping customs differ by state, and group splits can lead to confusion, our tax and tip calculator is your ultimate solution. Whether you’re dining out in California, splitting a hotel bill with friends, or managing a budget with discounts, this tool ensures accuracy, fairness, and ease.

By combining features like the split bill calculator with tax and tip , the “Do Not Tip on Tax” option, and discount integration , we’ve created a tool that adapts to your needs—no matter the situation. From calculating a $50 meal in Los Angeles to dividing a $200 travel expense among four people, the process is always clear, fast, and free.

The key takeaway is this: You don’t have to stress over calculations anymore . Let the tool handle the math while you focus on what matters—enjoying your meal, planning your trip, or staying within your budget. Whether you’re in California or another state, the calculator ensures you pay the right amount, every time.